FRESH! Versa Private Retirement Scheme! Versa PRS is here with 6% p.a! Now is the Best time to sign up. Receive RM50 and 6% p.a on your balance in Versa Cash.

PRS is like the sidekick to your trusty EPF. It’s a voluntary investment plan that helps you save up for your golden years while giving you more control over your financial destiny.

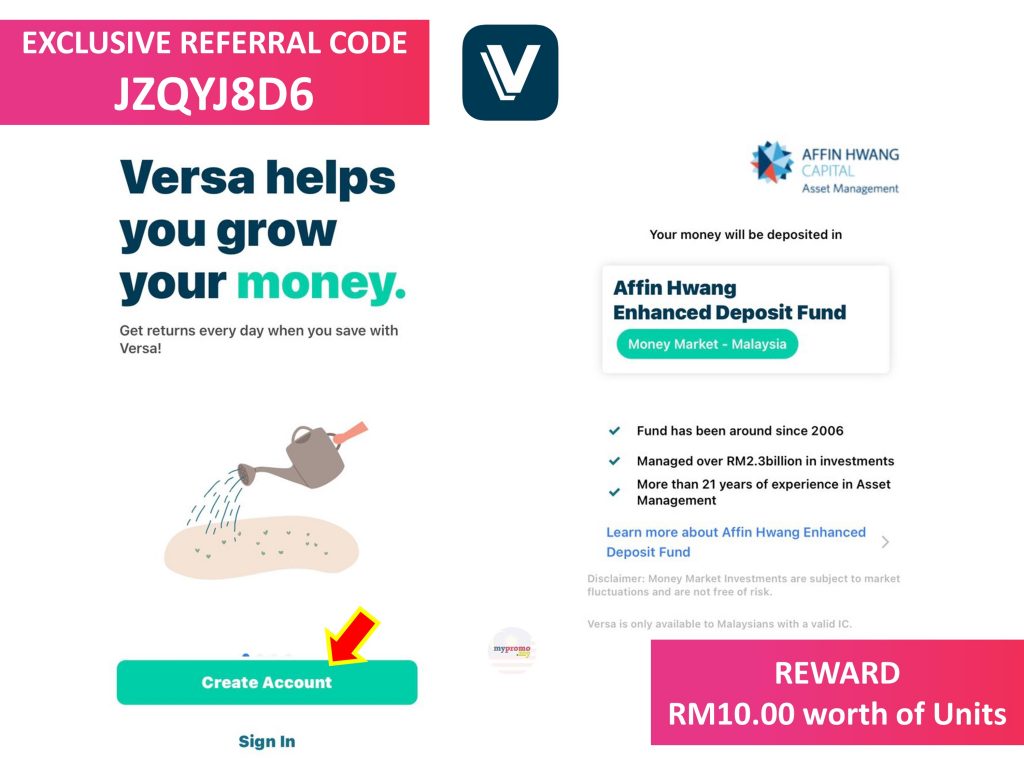

Sign Up Versa PRS with Referral Code JZQYJ8D6 and Get RM50 Reward

Start today!

👉 https://mypromo.my/versa

- You worked hard for your money, so make your money work hard for you.

- And get 4.3% per annum return rate on your first RM30,000!

What is Versa?

Versa is a digital cash management platform, is here to transform your sleeping cash into money-earning potential through return rates similar to the interest of a Fixed Deposit. With Versa, you can ‘duit’ your way and enjoy the freedom to withdraw your savings at any moment without penalties.

- Start saving with just RM100

- Earn FD like returns

- No lock-in periods, withdraw anytime

- No sales charges, no deposit/withdrawal or other hidden fees. No complications. No lock-in period.

How to Sign Up?

Follow these simple 10 steps and use our referral code JZQYJ8D6 to enjoy RM10 of Units. That’s an instant 10% return on your investment.

- Tap on this link: https://mypromo.my/versa

2. Download App and Tap to Open

3. Tap on Create Account

4. Key in your preferred Display Name and email address

5.Key in Promo or Referral Code: JZQYJ8D6

- Important Step for RM10 Reward! Get another RM40 (Total RM50) when your account reaches RM3,000 within a calendar year

6. Tap Create Account; key in OTP (sent via email) and Verify OTP

7. Set your Password

8. Next steps are all about Verification

> Verify your mobile number

> Verify your identity via Identity Card photos and a Selfie

> Submit additional details

9. Ok, all set and done. Now it’s time to deposit money to your account. Start with minimum RM100 to enjoy RM10 reward. Get another RM40 (Total RM50) when your account reaches RM3,000 within a calendar year

10. Done. They will verify your account and will take up to 5 business day for amount to be reflected in your balance.

Note: All investments involve some degree of risk!

Download Versa App

What’s PRS, You Ask?

[Source]

Did you know that according to the Employee Provident Fund (EPF), only 4% of Malaysians can actually afford to retire?

You’ve probably heard about retirement on the news or from your family. But it’s not just a far-off idea; it’s how you can achieve financial freedom. With inflation soaring and the cost of living on the rise, experts now say you should aim for at least RM1 million to retire comfortably. Sounds like a lot, right? Don’t worry; we’ve got your back!

Meet the Private Retirement Scheme (PRS). 🎉

Well, it’s not as complicated as it might sound. PRS is like the sidekick to your trusty EPF. It’s a voluntary investment plan that helps you save up for your golden years while giving you more control over your financial destiny.

How does it work?

We’ve teamed up with the experts at AHAM Capital to offer you six exciting PRS funds, catering to your preferences and risk appetite:

- Versa PRS Conservative

- Versa PRS Moderate

- Versa PRS Growth

- Versa PRS Shariah Conservative-i

- Versa PRS Shariah Moderate-i

- Versa PRS Shariah Growth-i

You can choose to invest in one or more of these funds, either through the default option or by picking your favourites. The default age applies only if you opt for the default option.

Every contribution you make will be divided into two accounts:

- 70% goes into Sub-Account A, which you can withdraw when you hit retirement age or if you leave Malaysia.

- 30% goes into Sub-Account B, available for withdrawal once per calendar year, subject to an 8% tax penalty on the pre-retirement withdrawal sum.

What are the benefits of investing with PRS?

Here are some reasons why PRS is your ticket to a brighter retirement:

- Affordable Start: You can get started with as little as RM100, and subsequent contributions of RM100. You can also invest in Versa’s PRS with a lump sum of RM3,000 and earn a Versa Cash Bonus of RM50 and 6% p.a. net returns in Versa Cash.

- Diversification: With a variety of funds to choose from, you can tailor your investments to match your goals, risk tolerance, and retirement timeline.

- Flexibility: You’re in control! Decide how much to invest, how often, and for how long.

- Long-Term Security: PRS is designed to ensure you can enjoy your retirement without worrying about your finances.

- Tax Benefits: You can get up to RM3,000 in tax relief every year <Link to other blog post> until 2025. That’s more money in your pocket!

- Easy Nomination: Safeguard your loved ones effortlessly through PRS nomination. It’s simple and secure.

Key Takeaway

If you’re looking to supercharge your retirement savings, PRS is the way to go. It offers the flexibility you want and the expertise you need to build a brighter future.

At Versa, we want to help you save more with rewards

Get a RM50* Versa Cash Bonus and a 6%* p.a. net return rate on your Versa Cash balance when you invest your first RM3,000 in any PRS fund.

But wait, there’s more – we want you to share the joy with a friend.

- Share your referral code to a friend.

- Your friend must make a first minimum cash in of RM100 in a single transaction into any Versa’s PRS funds. Both of you will receive a RM10 reward on your Versa Cash account.

- Once you friend’s total balance in his/her Versa PRS account reaches RM3,000 within a calendar year: Both of you will receive a RM40 reward each. This totals your referral reward to RM50! 💰💪

Ready to take charge of your retirement journey and secure financial freedom? Start today with Versa PRS. #YouCanDuit 🚀🌟

*T&Cs apply. Learn more here