RinggitPlus: Compare and Apply Personal Loans in Malaysia 2020

Need emergency funds? Your helpline is here, compare and choose the best Personal Loans in Malaysia 2020 and apply with a fast and easy online loan application.

Head over to ringgitplus.com to understand how personal loan work.

When should you apply for a personal loan? The truth is, there is never a best time to apply for a personal loan when you are not prepared for it.

If you are new to loan application, fret not, ringgitplus.com will explain in detail all the terms and jargons used to describe personal loan.

And if not sure what type of personal loan you should apply, ringgitplus.com will guide you and explain the differences between all type of loans like, Secured loan vs Unsecured loan, Conventional loan vs Islamic loan and With Takaful or Insurance vs Without Takaful or Insurance.

Do I need to apply for a personal loan?

If that’s the question you are asking yourself, here is the ringgitplus.com answers:

Everyone has goals to achieve in their lives and a lot of times, they require money to kickstart the journey. We can gain money from any means possible such as employment, selling of products or services, own savings, as well as loans.

Some people are lucky enough to fund their goals with one or more combinations of the above methods. But, what about others who has limited options or whose limited options are not viable?

Oftentimes, they shy away from the last option, which is loan. If we look at this objectively, applying for a personal loan is practical for several reasons:

- Education

- Investment

- Emergency cash

- Funding for business

- Buy a property (house, car, equipment etc)

- Debt consolidation.

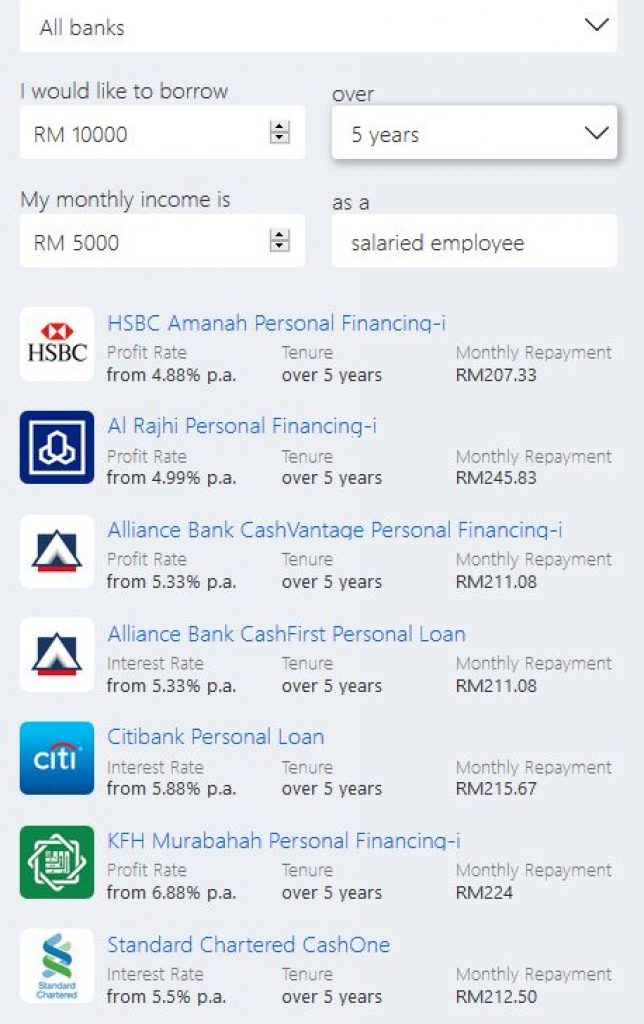

At RinggitPlus, they have wide range of personal loans that meet your needs with a fast and easy online loan application.

Visit ringgitplus.com NOW to continue reading…